KGI Portfolios are designed to pursue positive, relative results in bull markets, and hedged, out-performance during bear markets. From years of fundamental and technical research, I have found that minimizing losses in bear markets is a key ingredient for long-term outperformance. As Central Banks have implemented unprecedented amounts of low-interest rate debt into the global economy since the Great Financial Crisis of 2007-2009, markets have become addicted to this liquidity to keep prices and the economy elevated. The unfortunate reality is that this operation is unsustainable and has resulted in highly volatile returns across all markets.

A telling example of this can be seen from the returns of balanced portfolios and conservative portfolios in 2022, as the SP500 was down 21%, 10-year treasuries down 16%, leaving conservative investors down approximately 12-15% for the year, and long-term growth investors down from 22%-33%(NASD 100 was down 33%). This is certainly reminiscent of other recent bear markets occurring in 2000-2002, and 2007-2009, except for the fact that the “safe haven” of Treasury bonds was no longer safe and acted as a catalyst for negative returns in the equity markets. For this reason, every asset in the portfolios is technically reviewed and bought or sold based on its own fundamental and technical merits.

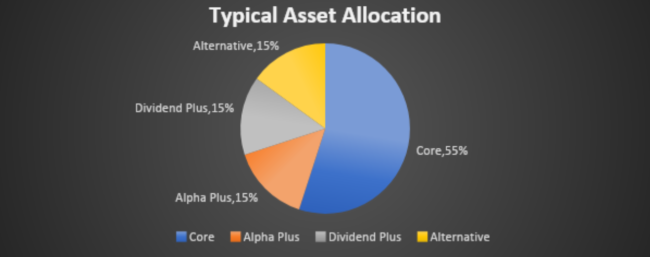

A typical portfolio is constructed by selecting one or two Core Portfolios and then diversified with two to three satellite portfolios.

|

Core Strategies NQ (Taxable) |

Core Strategy Qualified (IRAs, 401K’s) |

Satellite Strategy |

|

KGI Muni Equity Income |

KGI Qualified Income |

KGI Dividend Plus |

|

KGI APD Portfolios |

KGI APD Portfolios |

KGI Alpha Plus |

|

KGI Tactical |

KGI Tactical |

Structured Notes |

|

Alternative Strategies |

KGI APD Strategy

The KGI Active Passive Dynamic Portfolios seeks to maximize growth across three different risk parameters, Aggressive Growth, Moderate Growth, and Conservative Growth. The philosophy of the strategy maintains that long term average annual returns are maximized when losses are minimized during Bear Markets, and allocations are fully invested during bull markets. There are two “sleeves” for the account. The fist sleeve is based on a client’s risk tolerance and time frame, Aggressive, Moderate, Conservative. The second sleeve is the KGI Tactical Portfolio. The Tactical Portfolio acts as a hedge for the other sleeve during Bear Markets, and a performance enhancer during Bull Markets. It can also be used as a standalone portfolio.

*Asset allocation does not assure or guarantee better performance and cannot eliminate the risk of investment losses. There are no guarantees of performance. Past performance does not guarantee future results.

*The rates of return shown above are purely hypothetical and do not represent the performance of any individual investment or portfolio of investments. They are for illustrative purposes only and should not be used to predict future product performance. Specific rates of return, especially for extended times, will vary over time. There is also a higher degree of risk associated with investments that offer the potential for higher rates of return. You should consult with your representative before making any investment decision.

|

Tactical Portfolio |

Aggressive Portfolio |

Moderate Portfolio |

Conservative Portfolio |

|

Risk On |

Large Growth |

Large Growth |

Large Growth |

|

Long indexes/sectors |

Large Value |

Large Value |

Large Value |

|

|

Mid/Small |

Mid/Small |

Equity Income |

|

Risk Off |

International/Emerging |

International/Emerging |

Bonds |

|

Safety/Hedge |

Bonds |

|

Every allocation is customized to meet each individual client’s primary objective. For investors who are supplementing their incomes from the portfolio, the income need is determined first. Whatever amount of capital that is left is appropriately allocated to the satellite strategies.

Example 1

An investor with $1 million in non-qualified capital seeks to supplement his/her income with @ $30,000 of annual income. (Income based on current portfolio, not guaranteed)

|

Strategy |

Value |

Income |

|

KGI Muni Equity Income |

$550000.00 |

$30250.00 |

|

KGI Dividend Plus |

$150000.00 |

$5250.00 |

|

KGI Alpha Plus |

$150000.00 |

$0.00 |

|

Alternative Strategies |

$150000.00 |

$0.00 |

|

$1000000.00 |

$35,500.00 |

Example 2

An investor with $1 million in qualified accounts with the goal of moderate growth.

|

Strategy |

Value |

Income |

|

KGI Moderate APD |

$550000.00 |

$13750.00 |

|

KGI Dividend Plus |

$150000.00 |

$5250.00 |

|

KGI Alpha Plus |

$150000.00 |

$0.00 |

|

Alternative Strategies |

$150000.00 |

$0.00 |

|

$1000000.00 |

$19000.00 |